- The economic benefits of recycling Li-ion batteries are clear, but at present, only a small percentage of them are recycled. In contrast, lead-acid batteries have a 99% recycling rate in the US.

- The two main processes for recycling lithium-ion batteries are pyrometallurgy and hydrometallurgy. Each has its own set of environmental issues. Aqua Metals has pioneered a new electro-hydrometallurgy process that uses renewable electricity and recycles the chemicals used.

- Pyrometallurgy, which traditionally doesn’t recover carbon or lithium, seems likely to be phased out. Several companies are developing chemical processes, but these are still at pilot scale, and Aqua’s execs see serious challenges in delivering the required product purity and dealing with waste streams.

- Aqua Metals has a pilot line up and running, and is selling materials to customers in the metals industry. The company is building a new plant in Nevada, and aims to be processing 10,000 tons of black mass (equivalent to about 150,000 EV battery packs) annually by 2025.

Q&A with Aqua Metals execs Steve Cotton and David Regan

Regardless of the claims made in Facebook memes, Li-ion batteries are eminently recyclable, and current recycling methods cause far less environmental damage than the well-documented depredations of the petroleum industry. However, as sustainability is central to the mission of the EV industry, we need to hold ourselves to much higher standards than those of past transportation technologies, and there’s a long way to go before we have a true circular supply chain for batteries. Developing and scaling more sustainable recycling methods is a high priority.

There are currently two main processes for recycling lithium-ion batteries. These come under the general headings of pyrometallurgy and hydrometallurgy. Each has its own set of environmental issues. Aqua Metals has developed a process that it says is much cleaner, more efficient and more cost-effective. The company has a pilot line up and running to demonstrate its process, and has big plans to scale up its technology.

Charged spoke with Steve Cotton, CEO and President, and David Regan, VP of Commercial, about the different ways to recycle batteries, and the challenges of building a full-scale circular supply chain for batteries.

Charged: Your recycling process starts with black mass (which is not a heavy metal band, but rather the product of grinding up spent batteries). How does a battery pack turn into black mass?

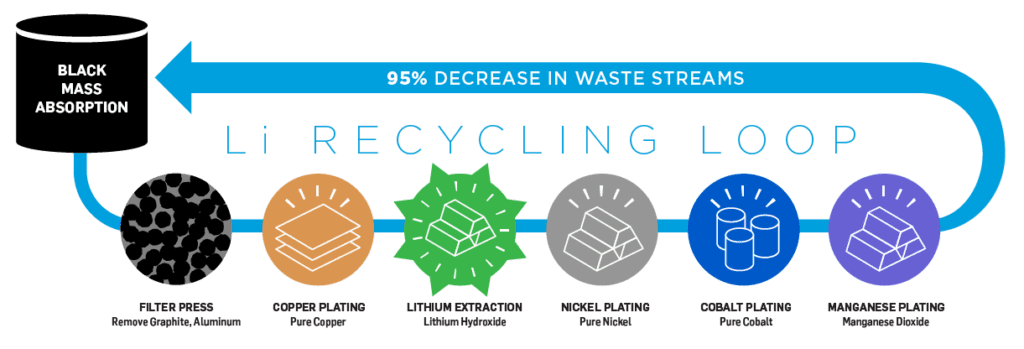

David Regan: There are two methods for recycling spent lithium-ion batteries. With one process, called pyrometallurgy, the batteries get thrown into a 3,000-degree furnace. But the start of a cleaner way of recycling is that you grind them up and separate the materials, and you create this material called black mass, which looks like a black sandy material. That becomes the amalgam of the critical battery minerals, including lithium and also cobalt, nickel, copper and manganese, depending upon the chemistry of the cell. Those are the main suite of critical battery minerals that you’re after when you recycle.

Aqua Metals works with companies that are really good at collecting, safely transporting, storing, crushing and separating spent lithium-ion batteries. That’s a whole suite of capabilities and technologies to generate that black mass. We take that black mass as the input to our process, which is then powered by 100% renewable, carbon-free energy. The output consists of those critical battery minerals and metals.

Charged: Do different companies handle different steps of the process that converts spent battery packs to minerals?

David Regan: There are a lot of companies in the ecosystem that do what they do best, so it’s common that one company handles the transportation, storage, and those kinds of things to make that black mass, then hands that off to the next company that does the finishing of those materials. That’s not to say that over the coming years, as we build a brand-new closed-loop recycling industry, that that doesn’t start to verticalize a little bit more. But for now, in this nascent industry, the common practice is that companies provide the black mass material to recyclers, who use the pyro methodology.

But one of the things the pyro process doesn’t recover is lithium. The lithium burns when you smelt black mass. With our process, we can recover the lithium as well as a higher percentage of all of the other metals and minerals. Then, after recovery of the minerals, there is taking those critical minerals and getting them to materials that are ready to go back into batteries.

Charged: Where are these batteries coming from at the moment?

David Regan: The feedstock varies. Consumer electronics are a good source. Smaller electronic devices are very rich in cobalt and nickel, because they need to be as powerful as possible with as little space and weight as possible. One stat for you: something like 147 typical iPhone batteries yield enough cobalt for an entire EV. Other batteries are coming from battery energy storage systems. Grid stabilization, solar arrays, wind farms, and even home energy storage systems—some of those are coming offline and already going to their second set of batteries.

Smaller electronic devices are very rich in cobalt and nickel. One stat for you: something like 147 typical iPhone batteries yield enough cobalt for an entire EV.

Some of the early EVs are coming in, including wrecked vehicles. Nissan Leafs are coming in now, the early Teslas are coming in. Power tools are another source that’s been around for a while.

We all say there’s a tidal wave of this material coming in in the near future. But there is enough material now to generate tens of thousands of tons of recovered critical minerals and put that back into the ecosystem. The more collection we do, the better for the environment.

Charged: How could we make sure more of that gets collected?

David Regan: I think it’s a regulatory issue. The EU requires recycling of lithium-ion batteries, so there’s a good deal of black mass creation happening there. We’re a little behind in that part, but we have passed the IRA recently.

We don’t mine a lot of these rare minerals in the US, so recycling is going to have to be a big portion of meeting the requirements of the IRA, which states that early on, about 40% of the materials need to be sourced out of the US or through US trade agreements, and it gets up to about 80% in 2030. That’s going to start incentivizing this, but I think there’s still more work to be done on the regulatory side.

We don’t mine a lot of these rare minerals in the US, so recycling is going to have to be a big portion of meeting the requirements of the IRA.

The IRA leaves it up to the folks that are making the batteries to try and get the material back and build a circular supply chain, which is essentially what happens with lead-acid batteries. We’ll see how it plays out with lithium. This industry wasn’t here a few years ago, so it’ll be interesting to see how everything evolves. But right now, used lead-acid batteries are a commodity.

Steve Cotton: If you buy a new lead-acid battery today, I’d say 80 to 90% of the lead that’s in that battery came out of old batteries, probably dating back to multiple uses. If you buy a new lithium battery today, almost none of the minerals came from a prior battery. They all came from mined materials. That’s what’s going to change over time.

The percentage of lithium-ion batteries that are actually recycled today is only about 5%, and that will go up to close to a hundred percent. In the lead space, close to 99% of those batteries now go into recycling, because it is a more mature industry.

David Regan: Few people know that lead-acid batteries are the most recycled commodity on earth—more than glass, more than cardboard. It’s a great sustainability story. The only challenge is that the actual recycling part of it is one of the dirtiest things you can do, which is smelting. We initially developed a lead-acid recycling technology that’s significantly cleaner, like 80, 90% lower emissions than the smelting process. However, the challenge we’ve had is that they’ve implemented this recycling infrastructure for lead-acid batteries for close to a hundred years now. To tear it out and replace it is a big challenge, and they’re not really incentivized from a regulatory perspective.

The percentage of lithium-ion batteries that are recycled today is only about 5%, and that will go up to close to a hundred percent. In the lead space, close to 99% of those batteries now go into recycling, because it is a more mature industry.

We need to set up this recycling infrastructure for lithium in a clean, environmentally sustainable way from the start, because if we get it wrong, asking companies to pull it out and sink all those costs is going to be really challenging. There’s some companies out there like Li-Cycle and Redwood, and the narrative in the media is that they’ve got this all figured out, but there are huge environmental challenges on their side that aren’t talked about. If we build out our infrastructure using that technology, it’s going to be a big step backwards, environmentally.

We need to set up this recycling infrastructure for lithium in a clean, environmentally sustainable way from the start, because if we get it wrong, asking companies to pull it out and sink all those costs is going to be really challenging.

Charged: How do the financial incentives to recycle lead compare to those for lithium-ion batteries?

Steve Cotton: A huge difference there. Lead is about $1,500, $2,000 a ton. The form of lithium hydroxide that we make with our process is ranging between $70,000 and $80,000 or more per ton. Cobalt is somewhere around $50,000 a ton, etc. The economics of recovering these critical minerals in the lithium space are much better than they are for lead. I like to say that, in the lead business, if someone sneezes, you go unprofitable that day, but in the lithium metal space, there’s room for some flexibility in the way that you do the process.

Lead is about $1,500, $2,000 a ton. The form of lithium hydroxide that we make with our process is ranging between $70,000 and $80,000 or more per ton. Cobalt is somewhere around $50,000 a ton.

Charged: Tell us more about the different ways to process black mass. How is your process different?

Steve Cotton: Our process is a hundred percent driven by electricity, as opposed to fire from fossil fuels, or chemicals that are one-time use in hydrometallurgical processes. We have a lower cost per ton to convert those materials, because we’re not managing a bunch of waste streams, we’re not bringing in a bunch of fossil fuels to fire up a process and managing all the environmental impact and logistics associated with these other processes.

David Regan: Pyro is the only technology currently in use to recycle lithium-ion batteries. Typically, you’re looking at a furnace of about 1,400 degrees C. The whole batteries go in, so the plastics get burned, the carbon gets burned, there’s a lot of emissions. They need to contain them. As more EVs come onto the market, and more EV batteries reach end of life, more batteries will be recycled. Once millions of tons of batteries are recycled annually to maintain the supply chain, these emissions are going to get really challenging. It’s going to be a big step backwards.

The EU has essentially poison-pilled pyro by saying you have to recover the carbon and the lithium out of the batteries, which makes it impossible to use current pyro. At some point, pyro is going to be phased out in the EU as an approach to recycle lithium-ion batteries, which pushes towards the chemical processes. But the other piece about pyro is that it’s inefficient. It produces an amalgam of all the metals, which then needs to be chemically separated. You’ve got the chemical waste streams, the chemical carbon footprint, as well as the furnace carbon footprint, and then you lose the lithium and you lose the manganese. It’s not efficient at all. It’s not really viable long-term.

The EU has essentially poison-pilled pyro by saying you have to recover the carbon and the lithium out of the batteries, which makes it impossible to use current pyro. At some point, pyro is going to be phased out in the EU as an approach to recycle lithium-ion batteries.

The chemical process is one where they start with black mass like we do and they use a process like a precipitation to pull out the valuable minerals. Typically, they’re shooting for salt forms. There are companies out there that are in development for this. They’re still at pilot or bench scale. There’s nothing that’s really running at commercial scale.

A lot of companies are years behind schedule because we think with this process, there’s real challenges in hitting product purity to meet spec for batteries. There are real challenges with waste streams—they yield a lot of sulfuric acid and sodium sulfate, which will need to get landfilled. There’s a company in England that announced they’re going to build a hydrochemical processing facility that will produce around a hundred thousand tons of sodium sulfate annually as a byproduct. Their plan is to pump that into the bottom of the ocean. As you might imagine, when we get to higher percentages of lithium and batteries being recycled, we can’t be pumping that much sodium sulfate into the ocean.

Li-Cycle, for example, has a facility, what they call their hub, that they’re planning on building in Rochester. That facility would have to hold 240,000 gallons of chemicals at any given time. They would rail in 90,000 gallons of chemicals a day. We would be using about 5% of those quantities, maybe less, for the same processing, because we recycle our chemicals. That lowers our costs and lowers our waste streams. We use renewable electricity to plate high-purity metals, which is much more efficient. We don’t have any additional refining that needs to happen—we can take the high-purity metals and go right into the battery supply chain.

Those are the highlight differences between the two other processes—the pyrometallurgical and hydrometallurgical. We’re a bit of a hybrid. We’re a hydroelectroplating process, but the chemicals we do use, we recycle. We don’t have the waste streams or the carbon footprint from those chemicals added to our process.

Charged: Are you familiar with Nth Cycle? Is their process similar to yours?

David Regan: Nth Cycle and Aqua Metals both use electrowinning, where an electric current is passed through a solution to recover metals. However, that is where the similarities end. Unlike Aqua Metals, Nth Cycle’s process uses standard chemical leaching, similar to other hydrometallurgy, and their products require further refining. Their business model is to be an intermediary in the recycling process. By comparison, Aqua Metals’ solution creates high-purity metals (nickel, cobalt, copper, etc) which can go right back into the supply chain, and we have a unique pathway to creating lithium hydroxide in a closed loop. We produce these materials at LME [London Metals Exchange] and battery grades, and can sell directly back to battery OEMs and CAM [cathode active material] producers.

Charged: Who sets the purity specifications? Are there industry standards, or does each customer have its own specs that they want to see?

David Regan: Our initial targets are based on the LME spec, but we’re going to be a little higher than those in the sense that certain impurities will be lower. We’re currently in conversations with potential offtake partners that will have their own specs. Initially, on the pilot level, we’re going to meet LME specs or better as we start running this and dialing in our process. But when we work with a specific offtake partner, we’ll be meeting their specific spec. That’s the challenge I think the hydrometallurgical folks are having as well—you need to get to very high purity and very specific specs with offtake partners, folks that are going to be making the CAM and the batteries.

Steve Cotton: Ultimately, the cathode active material is like the Duncan Hines brownie recipe—each individual battery manufacturer has IP related to their CAM. Each one has their own recipe. In working with those battery manufacturers, if you’re producing the CAM, that’s what you’re doing. What we’re doing ahead of that is plating those metals and making lithium hydroxide, which is a white powder. We take those materials and get recovery and reuse because the steel industry and the general metals industry are really desirous of copper and nickel and cobalt, for example, in metal form to get that into the materials that they make.

Any company trying to go directly to the CAM with powders, no one has yet proven that you can do that without going to the metal form first. But we know by our method of going to the metal form first, we can get there. We line the metals and then we make the battery materials. That’s great also for our business model, because you can’t be a sustainability business unless you have a sustainable business model.

We believe we’ll be hearing other companies saying, “We produce a lot of material, but we’re not in revenue yet—please allow 12 to 18 months for qualification of these materials to be bought directly by the battery industry.” But we’ll be saying, “We sold X tons and Y tons of cobalt and nickel and copper back into the industry.” Maybe not directly to batteries, but ultimately, as the company’s revenue streams grow, we’ll be adding value to those metals and getting those into cathode active materials.

Charged: So, at least in the early days, some of your customers might not be using these materials for batteries, but for other industrial uses.

Steve Cotton: Yeah, other uses, which in many cases may be associated with electrification, because there’s a lot of components in an EV that require nickel and cobalt that are not in the battery. Battery cell production and EV production uses a lot of steel. That needs a lot of nickel, and the battery vendors can’t steal all the nickel from the world. We need that nickel and other critical battery elements to be able to build the infrastructure and battery energy storage systems.

Charged: What about the anode? Graphite and silicon are also in the black mass, right? And in the pyro process, that stuff gets lost.

Steve Cotton: Yes, it gets burned away, including the plastics. You get VOCs, volatile organic chemicals, and things like that. You can put scrubbers and try to prevent some of the particulate matter from getting out, but it gets out, especially the CO2. You can’t filter out CO2. What we do is, we sequester the carbon today, but in the longer run, we would like to be able to get that into graphite and graphene-grade quality to be able to put that back into the battery chain. That’s horizon two, I would say, of our recycling.

Charged: It sounds like working with your customers is a complex process. You can’t just call up a battery maker and say, “Hey, I got some nickel and cobalt here, how much you want?”

David Regan: No, it’s a very close working technical relationship. You have to go through the process to meet their product specs. We actually did this with Clarios, the largest battery manufacturer in the world, when we were running our lead recycling business. It’s a very involved process. It takes several months. Any company looking to recycle battery materials back into the supply chain is going to have to go through a lengthy approval process and work very closely with potential partners.

Steve Cotton: Which we’re very actively doing, but in the meantime, we can sell the cobalt and nickel and copper through the LME and other direct-sale markets.

The buyers of the battery-grade materials that we’ll be announcing are going to be really critical, because if you’re a Ford or a GM or a Stellantis or a Tesla, you have to show that you’re driving towards net zero. If we just trade fossil fuels for a bunch of carbon and waste streams and lithium, what have we solved?

What really matters to the supply chain world is Scope 1 emissions. If those guys are buying their battery materials from dirty sources, they’re never going to achieve net zero. If they’re buying those materials from clean sources, they are getting a long way further towards net zero. That’s really what we aim to be: the net zero battery minerals company.

If you’re a Ford or a GM or a Stellantis or a Tesla, you have to show that you’re driving towards net zero. If we just trade fossil fuels for a bunch of carbon and waste streams and lithium, what have we solved?

We already are a hundred percent renewable energy and a hundred percent carbon-free through renewable energy credits and very minuscule carbon offset fees, because we don’t really generate any carbon of any consequence.

Charged: I know traceability is a big issue. Do you have formal processes in place to document the sustainability of what you’re doing?

Steve Cotton: We already documented the renewable energy credits for the gap between our source of power here, which is NV Energy, that’s already running at like 30, 40% renewables. We take the mass balance of our operations and then get those renewable energy credits. Our new campus has a full solar roof and solar parking structures, EV charging infrastructure. We’ll begin to co-generate, and therefore have to buy less renewable energy credits to get where we need to be. But we have to be very transparent. As a publicly held company, we are held to a high standard compared to some of the private companies.

David Regan: We’re going to have a third party verify our carbon footprint this year as we get actuals running off the pilot. And then our goal is to hit net zero as commercially operating when we’re at 10,000 tonnes and beyond. That will be well-documented, and we’re in a process now of establishing how that will work and how we’ll document that at the commercial scale. That’s going into the whole planning process. But we will, at the pilot stage, have third-party verification of our carbon footprint and environmental impact.

from Charged EVs https://ift.tt/rWiU8v0

No comments:

Post a Comment